Don’t have your registration number? No problem, click here.

Drive with Confidence - Find the Right Black Box Car Insurance

Black box insurance is a type of cover where a device is installed in your car to monitor your driving performance. This lets insurance providers know how you’re driving and adjust the cost of your policy accordingly. While some people think black boxes are intrusive, they can be an excellent way to save money on cheap car insurance with a black box, particularly for new drivers with no driving history. Hopefully, we can help you find the cheapest black box car insurance in the UK!

You can get black box insurance quotes now by clicking the green button. If you’d like to find out more about the types of cover you can get as well as ways to save money and additional cover options, then read on.

Don’t have your registration number? No problem, click here.

Did you know…?

Black boxes use GPS data that your insurance company uses to assess your driving and calculate your premiumWhy You Should Get Black Box Car Insurance

A black box policy will be adjusted according to your driving performance. While this can mean you’ll pay more if you speed regularly, it also means you can benefit from lower cover if you’re a sensible driver.

How does a Black Box work?

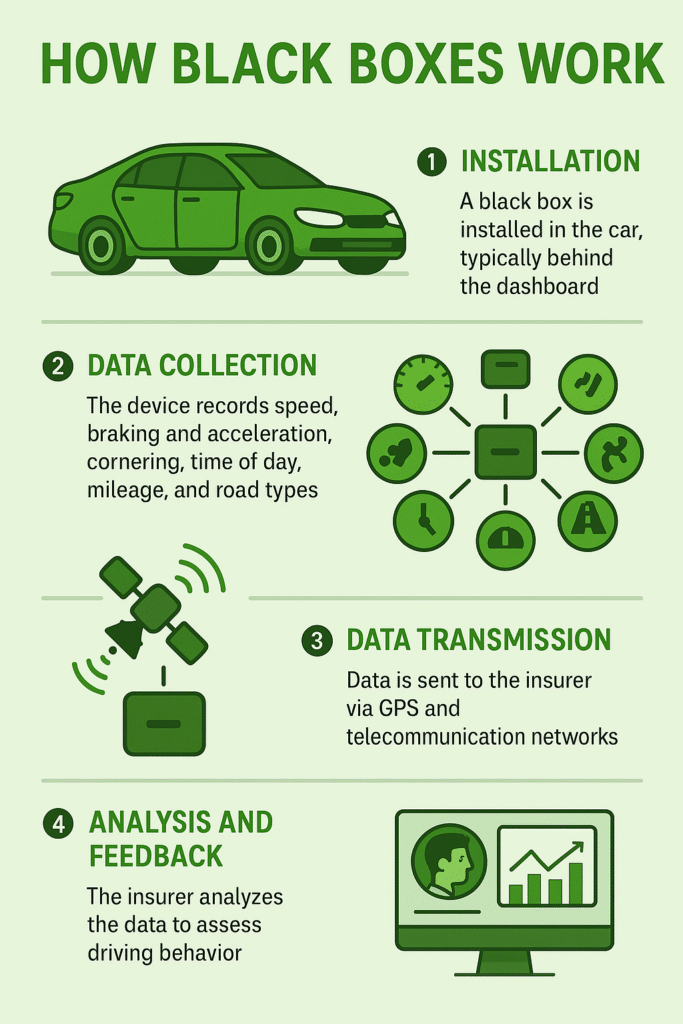

A Black Box or telematics device tracks various aspects of your driving, such as speed, acceleration, braking, cornering, and the time of day you drive. It also uses GPS technology to record your location and mileage and the data collected is then transmitted to your insurance company. The infographic below gives you a visual explanation.

Types Of Black Box Car Insurance Cover

Don’t have your registration number? No problem, click here.

Did you know…?

Although it's often thought of as being for new drivers, black box insurance can also help older drivers to save money too.Why Getting Black Box Car Insurance Is Recommended

Check out the reasons below for why you should get Black Box Car Insurance quotes.

- They serve as informative resources on what makes up good coverage, bolstering user confidence in finding reliable car insurance at a fair price.

- These sites are accessible 24/7, accommodating busy individuals who can't shop for insurance during normal business hours.

- The process is efficient, requiring users to enter their information only once, eliminating the need to fill out long forms for each provider.

- Comparison websites offer cost-effectiveness by allowing side-by-side comparison of quotes and policies, ensuring transparency in prices and features for informed decision-making.

- Robust security measures are employed to ensure data security, so users need not worry about their information's safety.

- Some comparison websites offer renewal reminders to help customers seize savings opportunities.

Optional Forms Of Black Box Car Insurance

See below for some optional types of Black Box Car Insurance.

- Breakdown Cover: With this add-on, you receive roadside assistance whenever your vehicle breaks down, providing you with peace of mind during every journey.

- Legal Cover: This provides financial protection against any legal costs you might incur if you're involved in a legal dispute related to a road incident.

- Courtesy Car Cover: If your car needs repairs after an accident, this cover ensures you're provided with a courtesy car, so your daily routine isn't disrupted.

- Windscreen Cover: This cover provides protection against any damage to your windscreen, ensuring your view of the road remains crystal clear.

- Personal Accident Cover: This provides you with a financial safety net in the unfortunate event of a severe accident, covering you or any named driver for certain injuries.

- Key Cover: This offers you protection against the loss or theft of your car keys, covering the cost of replacement and even the locksmith's charges.

- No Claims Discount Protection: With this, your no claims discount remains intact even if you make a claim, helping you maintain lower premiums in the future.

- Excess Protection Cover: This covers the cost of your excess should you need to make a claim, meaning you won't be out of pocket when you most need it.

- Uninsured Driver Protection: This ensures you're not left out of pocket if an uninsured driver hits your vehicle, covering your excess and protecting your no claims discount.

- Foreign Use Cover: This extends your cover for driving abroad, providing you with the same level of protection as you enjoy at home.

- Misfuelling Cover: Protects you against any repair costs if you accidentally put the wrong fuel in your car.

- Child Car Seat Cover: In case of an accident, this cover provides funds for the replacement of any child car seats, even if there's no visible damage.

Don’t have your registration number? No problem, click here.

Did you know…?

There are other factors that impact how much you pay for insurance. These include your age, location and driving history.How To Save Money On Black Box Car Insurance

Below are some great ways to save money on Black Box Car Insurance

- No Claims Discount: Insurers may offer discounts to drivers who have not made a claim in a while. The longer you go without making a claim, the larger the discount could be.

- Higher Excess: Agreeing to pay a higher voluntary excess (the amount you pay towards any claim) can lower your insurance premium. However, ensure that you can afford the excess in case you need to make a claim.

- Limit Optional Extras: While optional extras can provide valuable additional coverage, they also add to the cost of your premium. Make sure any extras you choose are truly necessary.

- Maintain a Good Credit Score: Some insurers consider credit score when determining premiums. A good credit score can demonstrate that you're reliable and may lead to lower costs.

- Advanced Driving Courses: Some insurers may offer discounts if you've completed an advanced driving course, such as those offered by the Institute of Advanced Motorists.

- Review Your Coverage Annually: As your life changes, so do your insurance needs. Review your policy annually to make sure you're not paying for unnecessary coverage.

Compare Black Box Car Insurance Quotes Now!

Finding the ideal car insurance a cinch. when you use the comparison service Here's the plan:- You start by entering your personal information - your privacy is their utmost concern.

- Then, provide the details of your vehicle - the more accurate, the better your matches.

- Next up, fill in your current insurance details - this helps them tailor the perfect solutions.

- Wait a bit, and specialist insurance providers will reach out with bespoke quotes.

Don’t have your registration number? No problem, click here.

Black Box Car Insurance FAQs

Will I save money by getting black box insurance?

You definitely can but it’s dependent on your driving behaviour. Because black box policies can be adjusted at any time, you can either end up paying more or less depending on how you drive.

Are black box policies only for younger drivers?

No. Although a lot of young drivers do get black box policies, you can also benefit from getting one as an older driver, particularly if you know that you never break the speeding limit.

Are there any other ways to save money?

Yes. You can also lower the cost of your insurance by –

- Paying annually

- Parking your car in a garage

- Limiting the cover options on your policy

Don’t have your registration number? No problem, click here.